- Tanim Prodhan

- Posts

- 💰 The Game of Debt: Why “Who Owes Whom” Determines Wealth

💰 The Game of Debt: Why “Who Owes Whom” Determines Wealth

Have you ever wondered why some people seem to grow richer the more debt they take on — while others drown in it?

It’s because most people never learned the real game of money: Who is indebted to whom.

🎯 The Core Idea

As Rich Dad said, “The more people you are indebted to, the poorer you are. The more people who are indebted to you, the richer you are.”

That’s not just a quote — it’s the operating principle of capitalism.

The entire money system — from personal loans to national economies — revolves around debt and confidence.

Understanding which side of that equation you’re on is what separates the poor, middle class, and rich.

Most people think money is wealth. But money itself is debt.

Every dollar in circulation is an IOU — a promise backed not by gold or silver, but by the taxpayer’s ability to work and repay.

It’s only valuable as long as people believe in that promise.

If you want to learn about money, then click the link below:

That’s why the global economy runs on two invisible forces:

Debt — who owes whom.

Confidence — the belief that debts will be repaid.

🏦 The Two Sides of Debt

Let’s break down the two types of debt relationships in simple terms:

Perspective | Description | Outcome |

Being Indebted (Poorer Side) | You owe money to others — banks, credit cards, lenders, or even employers (via your dependence on your paycheck). | You’re working to pay someone else. |

Having Others Indebted to You (Richer Side) | Others owe you money — through rents, interest payments, royalties, or business income. | Your money works for you. |

The wealthy understand this:

They use leverage to have assets (like properties, businesses, or systems) that generate cash flow from others’ efforts or debts.

The poor and middle class, on the other hand, use debt for consumption — cars, phones, and houses that cost them monthly payments but produce no income.

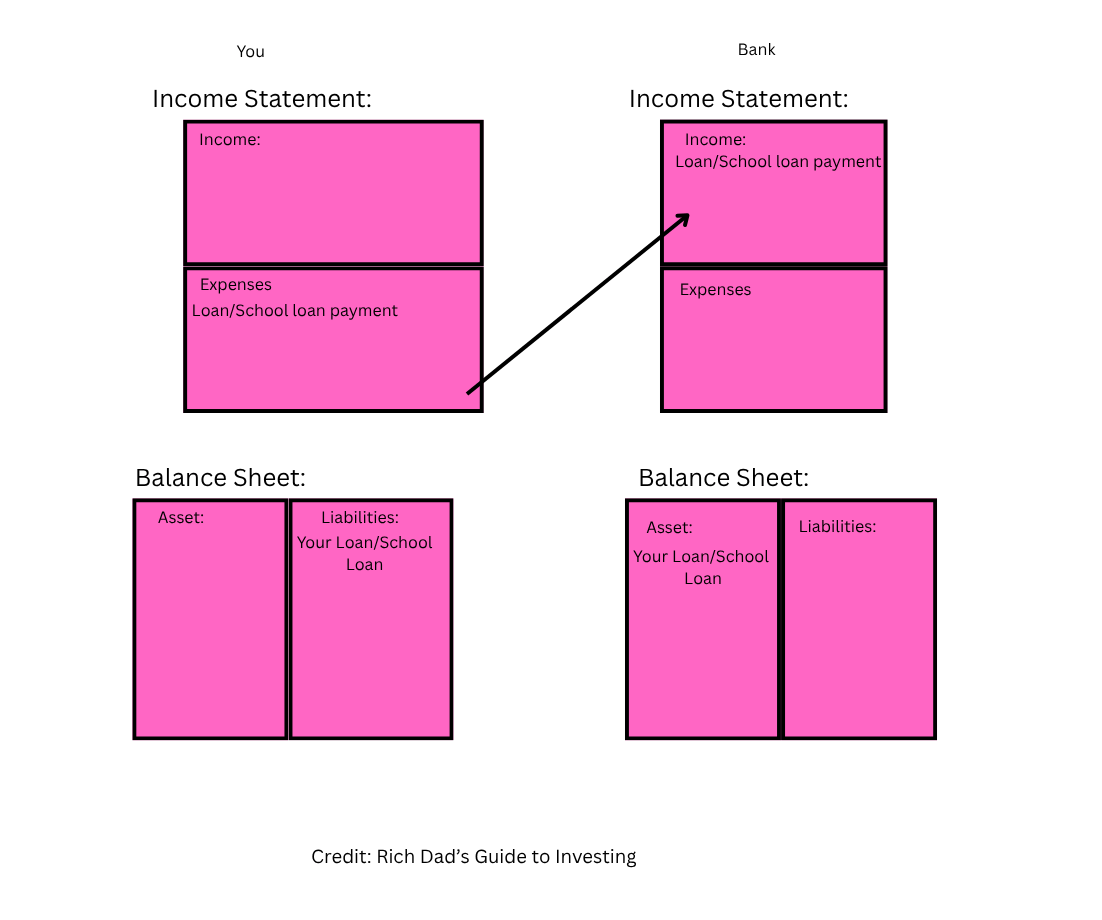

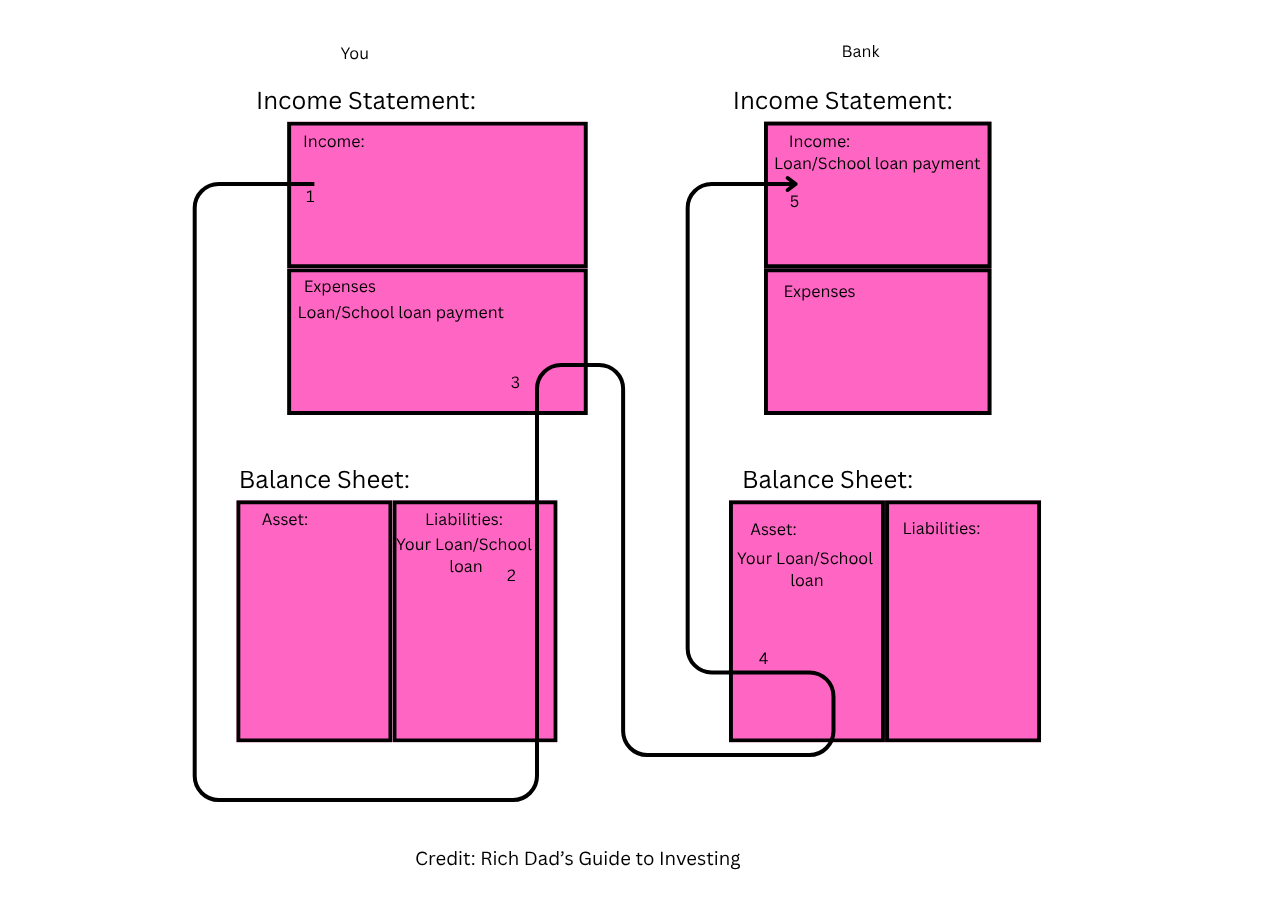

To understand this concept, we need to see two financial statements.

📊 Why You Need TWO Financial Statements to See the Full Picture

Most people only ever see one side of the story — their personal financial statement (their own income and expenses).

But as Rich Dad explains in Rich Dad’s Guide to Investing, you can’t understand the true flow of money until you also see the other person’s financial statement — the one on the other side of your transaction.

Basics:

For every liability on your statement (Balance sheet), there’s an asset on someone else’s. In other words, your liabilities are someone else’s assets and vice versa.

Each expense you make will go to the income statement of the other. In other words, your expense is someone else’s income.

To illustrate:

A) Your expenses are someone else’s income and vice versa.

Your expenses are someone else’s income and vice versa.

When you pay the bill for your food (expense) in the restaurant, the cashier recieves the payment (Income).

B) Your liabilities are someone else’s assets and vice versa.

Your liabilities are someone else’s assets and vice versa.

You pay your car loan (Liability for you) to the bank. The bank gets money from your car loan (an Asset for the bank).

Remember:

Assets put money into your pocket.

Liabilities take money out of your pocket.

That is the reason it takes two financial statements to see the entire picture.

Rich People have a lot of financial statements. If you want to learn about it, then click the link below to read the book:

🔍 Example: The Tenant and the Landlord

Tenant’s View: Rent is an expense.

Landlord’s View: Rent is income.

If you’re the tenant, you’re indebted every month — your money flows away.

If you’re the landlord, others’ rent payments build your wealth.

🔍 Example: The Bank and the Borrower (“Debt Creates Wealth — But For Whom?”)

Borrower’s View: The loan is a liability.

Bank’s View: The same loan is an asset that earns interest.

That’s the invisible rule of the game — what makes one person poorer makes another richer.

🧩 The Core Principle

“The game of capitalism,” Rich Dad said, “is about who owes whom.”

If you owe everyone — banks, credit cards, landlords — you’re playing defense.

If others owe you — tenants, borrowers, or customers — you’re playing offense.

That’s why most people stay trapped on the left side of the Cashflow Quadrant (E and S) — exchanging time for money, constantly indebted to taxes, expenses, and loans.

The wealthy move to the right side (B and I) — building systems and assets that make others’ money flow toward them.

People who are out of control of their finances make others rich.

People who make a lot of expenses (buying expensive gadgets, paying for food) make others rich because the seller of the goods earns a lot of money from them.

People who own a lot of liabilities make others rich.

People who own a lot of liabilities have to pay a lot of bills for owning them (Rent, mortgages, loans, taxes, maintenance). The people who get the bills from the liabilities of others have it as income. Always remember, more liabilities equal to more expenses.

People who are in control of their finances make themselves rich.

People who are in control of their finances spend most of the money they earn to buy assets. They have low expenses and try to own as less liabilities as possible. They invest in their education on finance regularly to minimize the risk of their investments. That is why the rich are rich.

The people who donot learn about finance keep struggling. For this reason, it is important to invest in your education in finance. If you are interested in learning about finance, then join my newsletter. It’s free. Without learning about finances, you will keep struggling with money. Join by clicking the link below 👇:

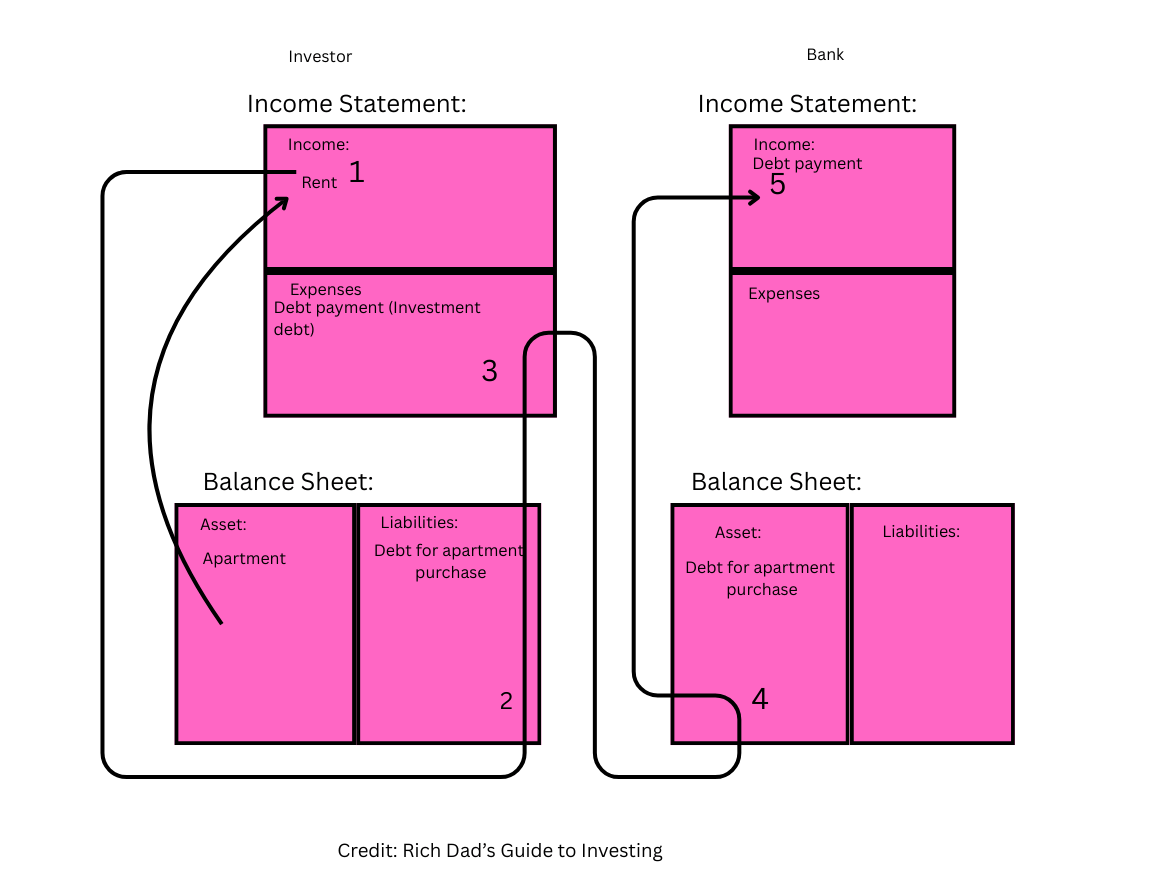

🧮 The Math of Debt Flow

Let’s visualize two people with the same $100,000 loan:

Person A (Consumer Debt):

Borrows $100,000 for a car and personal expenses.

Pays $1,000/month in installments.

No income from debt → all outflow.

Person B (Investment Debt):

Borrows $100,000 to buy an apartment.

Collects $1,200/month rent.

Pays $1,000/month in loan → $200 positive cash flow.

Both have the same amount of debt.

But one gets poorer monthly, while the other gets richer monthly — because one is paying the interest, and the other is earning it.

The difference between Person A and Person B is that Person B is getting money even though he has a liability. Whereas Person A took the money for the car and personal expenses. If he were financially educated, he would know how that debt would benefit him, as seen with person B. Or, at least know how to turn the car into an asset (by putting it on rent).

Apply what you are learning after reading it fully.

Click here to get it.

💥 Why the Poor Stay Poor

The poor are overloaded with personal debt — car loans, credit cards, mortgages — all liabilities that drain income.

They work for others, pay interest to banks, and rent from landlords.

Every line on their financial statement represents someone else’s profit.

As Rich Dad warned, “If you take on debt and risk, you should get paid for it.”

But most people take the risk — and someone else gets the reward.

🌍 Real-Life Example

Consider two neighbors in 2025:

Alex buys a luxury car on a loan — monthly payment: $800.

Jamie uses the same $800 to pay the mortgage on a small rental unit.

After five years:

Alex owns a depreciated car.

Jamie owns an appreciating asset and receives monthly rent.

Both spent the same amount.

Only one learned the real game: make debt work for you, not against you.

🧩 Key Lessons

Every debt creates a relationship — one side owes, the other profits.

If you take on risk and debt, ensure it earns income.

Always look at two financial statements — yours and the counterparty’s — to understand who’s really winning.

Debt isn’t evil — ignorance of it is.

Wealth grows through structure — having others indebted to your systems, not being indebted to theirs.

✅ Action Guide

Review your own financial statement.

Write down all your liabilities and ask: “Who’s earning from this?”Create a mirror statement for those you pay money to — landlord, bank, etc.

This shows their perspective of your debt.Start converting liabilities into assets.

Example: Move from renting to owning a small income-generating property.Track your cash flow monthly.

You’ll see whether you’re playing offense or defense.Educate yourself.

Learn the language of finance, leverage, and structure — the true game rules.

⚠️ Disclaimer

This newsletter is for educational purposes only and is not financial advice.

Always consult with a qualified financial advisor before making any investment or borrowing decisions.

The Rich constantly educate themselves on matters of money.

📚 By the way:

This lesson comes straight from Rich Dad’s Guide to Investing — a book that doesn’t just teach how to make money, but how to see money differently.

If you want to understand how capitalism truly works, and how to move from being indebted to others to having others indebted to you, this is your starting point.

👉 Read “Cashflow Quadrant” and “Guide to Investing” to learn how to see both sides of the financial statement — and finally play the game to win.

and,

To read more on:

🧮 How to Identify a Defined Benefit vs. Defined Contribution Pension Plan (Beginners’ Guide)

Teach Kids to Think Like Entrepreneurs, Not Employees

“Why Most People Stay Broke: The Debt Trap Explained”

If you are enjoying the newsletter so far then consider joining the newsletter as we share many things on finances and lessons. These are clearly not investing advices but lessons. I share what I learn from books and I add other educational things too. You will like joining my newsletter. You can also read the other ones that I have written too. Join my newsletter with the link below👇: