- Tanim Prodhan

- Posts

- Is Your Banker Telling the Truth? The Big Lie About Assets

Is Your Banker Telling the Truth? The Big Lie About Assets

If your house is an asset, why is it listed on your bank's balance sheet and not yours?

Rich Dad once said, "Your advisers can only be as smart as you are." That one sentence changed how the author, Robert Kiyosaki viewed money, people, and advice. The hard truth is this: If you're financially uneducated, your advisers must legally offer you only low-risk, low-return strategies—like savings accounts, 401(k)s, and diversification. These aren't bad, but they won't build wealth either.

But if you're financially educated, advisers can unlock the next level—access to deals, strategies, and wealth-building systems most people will never hear about. That level begins with you.

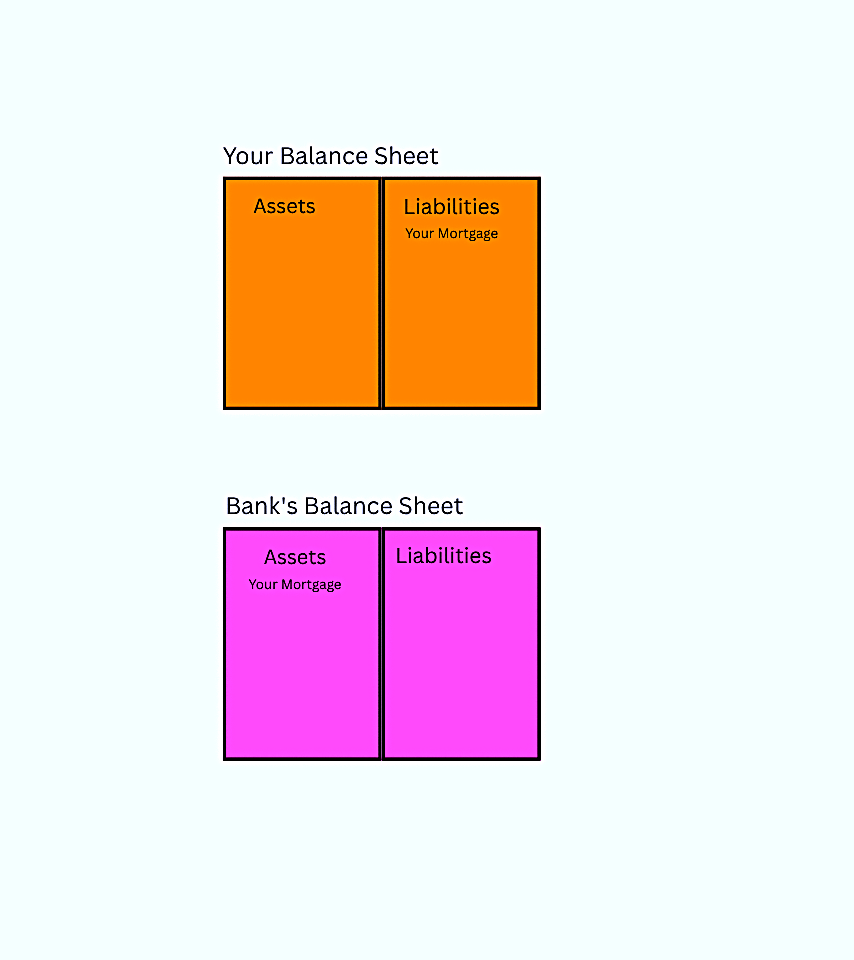

Let’s break it down with a classic example: your home. Your banker tells you it’s an asset. But whose asset? Not yours.

Your mortgage is a liability on your balance sheet, taking money out of your pocket every month. The same mortgage is an asset on the bank's balance sheet because it brings them monthly income. Now ask yourself: who's really winning?

The true Picture:

This is how the financial system is set up. The less you know, the more you pay—literally. The wealthy understand this game at a deeper level. They know how to make liabilities pay them. They know how to use debt to build wealth. They know how to turn knowledge into leverage.

Most people never get there because they’re stuck in a system that rewards conformity, not curiosity.

Once you step out of that mindset, everything changes. You start seeing the system for what it really is—a set of rules. And rules can be learned. Rules can be mastered.

If you’re willing to study the Cashflow Quadrant, to see the difference between E/S and B/I thinking, you’ll realize something powerful: financial freedom isn’t about working harder—it’s about thinking smarter.

Key Lessons:

Your adviser is limited by your financial intelligence.

Most financial advice is simplified for mass consumption.

Financial literacy opens up access to sophisticated strategies.

Banks win because they understand accounting from a business and investor (B and I) perspective.

Your house isn’t your asset until it puts cash into your pocket.

High-level advice becomes available only when your knowledge matches the complexity.

Financial education is not a luxury—it’s a necessity in today’s economy.

🚨 Education Disclaimer:

This newsletter is for educational purposes only. I am not a licensed financial adviser. I do not offer investment, tax, or legal advice. You are responsible for your own financial decisions. My goal is to simplify and explain concepts to empower you with knowledge, not to direct your actions.

📘 Want to Learn More?

This idea is adapted from Cashflow Quadrant by Robert Kiyosaki. It's a good book about wealth that I've read. If you’re serious about changing your mindset, read it. It's a game changer. Click the link to get the book:

💌 Enjoyed This?

Subscribe to the newsletter for more insights, mental frameworks, and bonuses every week.

Bonus:

Is your house really an asset?

Or, read the post to learn about it with the link below:

To read more on:

The Pension Illusion: Why the Rules Have Changed

What are the forms of money? A comprehensive Guide.

"Why Smart People Make Dumb Money Mistakes"

If you want to learn more things like this and other educational things, then join my newsletter. Here, we share a lot of contents like this and we hope you will like reading them. We talk about financial education, and other books. if you want to learn them then sign up with the link below 👇: